Home Loans A Guide for People with Poor Credit Scores

At some point in life, we all need financial assistance to achieve our goals. However, if you have a poor credit score, you may find it challenging to obtain a home loan. This is because lenders use your credit score to determine your creditworthiness, which affects their decision to approve or deny your loan application. In this guide, we will provide you with comprehensive information on how to obtain a home loan even with a poor credit score.

Introduction

Home Loans A Guide for People with Poor Credit Scores

A home loan is a type of loan that is used to purchase a home or property. The borrower agrees to repay the loan amount plus interest over a set period of time, typically 15 to 30 years. The property being purchased is often used as collateral for the loan.

Home loans can come from a variety of lenders, including banks, credit unions, and mortgage companies. The interest rates and terms of the loan can vary depending on the lender and the borrower’s financial situation.

Sure, there’s a table form of the documents typically required for a home loan application:

Need Document for the Home Loan

Home Loans A Guide for People with Poor Credit Scores

| Document | Description |

|---|---|

| Proof of Identity | Passport, driver’s license, or any other government-issued identification |

| Proof of Income | Salary slips, employment letters, and income tax returns |

| Property Documents | Property papers, a title deed, and a sale agreement |

| Address Proof | Utility bills, such as electricity bills or telephone bills |

| Employment Details | Company name, address, and contact details |

| Property Valuation Report | An estimate of the property’s value |

| Credit Score Report | Details about your credit score and credit history |

| Photographs | Passport-sized photographs of all applicants |

| Click for other Information | Bankrate.com |

| Declaration of Other Loans |

What is the Credit Score?

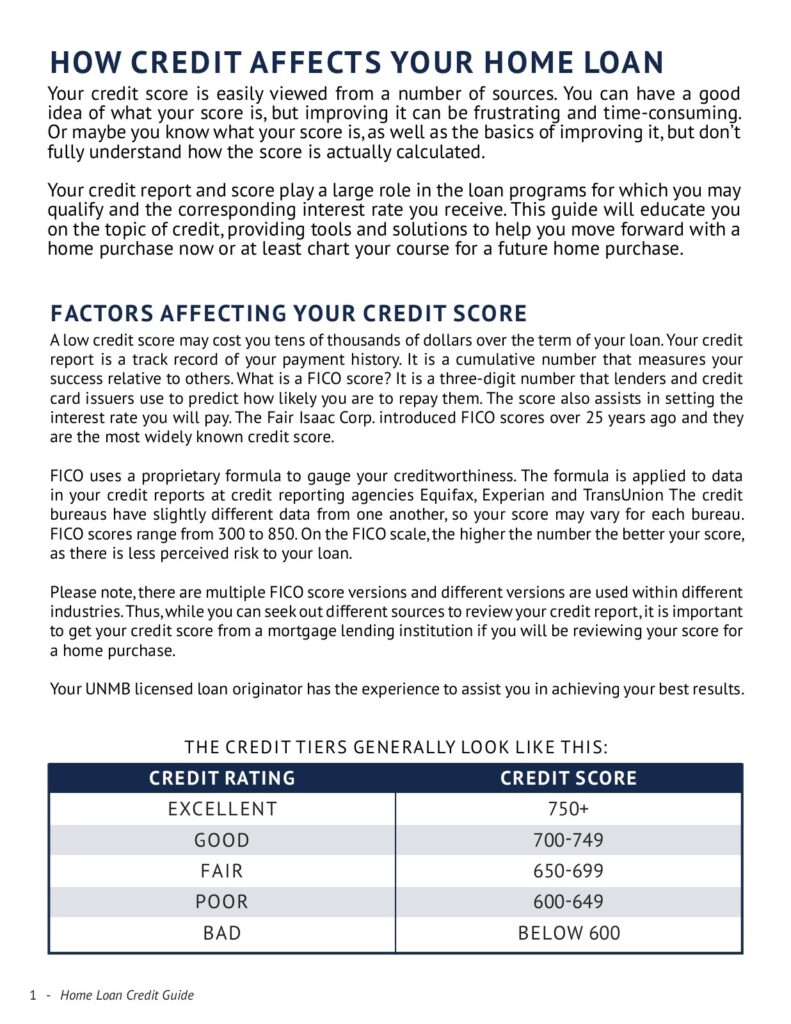

Your credit score is a number that represents your creditworthiness based on your credit history. It ranges from 300 to 850, with higher scores indicating a better credit history. Lenders use your credit score to determine your risk level, and this affects their decision to approve or deny your loan application.

Why is your credit score important when applying for a home loan?

Your credit score is a crucial factor when it comes to obtaining a home loan. This is because lenders use it to determine your creditworthiness, which affects their decision to approve or deny your loan application. A poor credit score indicates that you are a high-risk borrower, and lenders may be hesitant to approve your loan application

How can you improve your credit score?

- Pay your electric and other Government bills on time: Late payments bills can negatively impact your credit score, so make sure you pay your bills on time.

- Keep your credit utilization low: Credit utilization is the amount of credit you are using compared to the amount you have available. Aim to keep your credit utilization below 30%.

- Check your credit report for errors: Errors on your credit report can hurt your credit score, so make sure to check it regularly and dispute any errors you find.

- Don’t open too many new credit accounts: Opening too many new credit accounts in a short period can negatively impact your credit score.

- Keep your old credit accounts open: The length of your credit history is an essential factor in your credit score, so keep your old credit accounts open even if you don’t use them.

What are your home loan options with a poor credit score?

Despite having a poor credit score, you still have options when it comes to obtaining a home loan. Here are some options to consider:

FHA loans: FHA loans are backed by the Federal Housing Administration and are designed to help people with low credit scores obtain a home loan. The minimum credit score requirement for an FHA loan is 500, but you may need a higher credit score to qualify for a lower down payment.

VA loans: VA loans are backed by the Department of Veterans Affairs and are available to current and former members of the military and their spouses. VA loans do not have a minimum credit score requirement, but lenders may have their own requirements.

Dollars loans: USDA loans are backed by the U.S. Department of Agriculture and are available to people in rural areas. The minimum credit score requirement for a USDA loan is 640.

Subprime loans: Subprime loans are design for people with poor credit scores. However, they often come with higher interest rates and fees, so make sure you understand the terms before accepting a subprime loan.

Cosigner: You may be able to obtain a home loan with a poor credit score by having a cosigner with good credit. However, remember that the cosigner is equally responsible for the loan, and their credit score will also be impacted if you fail to make payments.

What Should You Consider Before Applying for a Home Loan?

Before applying for a home loan, there are several factors to consider. In this article, we will explore some of the key considerations to help you make informed decisions when applying for a home loan.

Determine your budget

Before you apply for a home loan, it is important to determine how much you can afford to spend on home loans. Consider your monthly salary, expenses, and any other financial obligations you may have. This will help you determine a budget for your home purchase and ensure that you do not overextend yourself financially.

Check your credit score

Your credit score is an important part that lenders consider when evaluating your loan application form. A good credit score can help you secure a better interest rate and loan terms, while a poor credit score can make it difficult to get approve for a loan. Before applying form for a home loan, check your credit score and take steps to improve it if necessary.

Save for a down payment

Most home loans require a down payment, which is a percentage of the total purchase price of the home. Saving for a down payment can take time, but it can also help you secure a better loan and lower your monthly mortgage payments. Determine how much you need to save for a down payment and start setting aside funds as early as possible.

Shop around for lenders

Not all lenders offer the same loan terms or interest rates, so it is important to shop around and compare offers from multiple lenders. Consider factors such as interest rates, loan fees, and customer service when evaluating lenders. This can help you find the best home loan for your needs and budget.

Understand the loan terms

Before signing a loan agreement, it is essential to understand the terms of the loan. This includes the interest rate, loan duration, and any fees or penalties associated with the loan. Ensure you fully understand the loan terms before agreeing to them and ask questions if anything is unclear.

Consider additional expenses

When purchasing a home, there are often additional expenses beyond the cost of the home and the loan. These can include closing costs, property taxes, and home insurance.

Get pre-approve for a loan

Getting pre-approved for a home loan can help you determine how much you can afford to spend on a home and make the home-buying process smoother. Pre-approval involves a lender evaluating your financial information and determining how much they are willing to lend you.