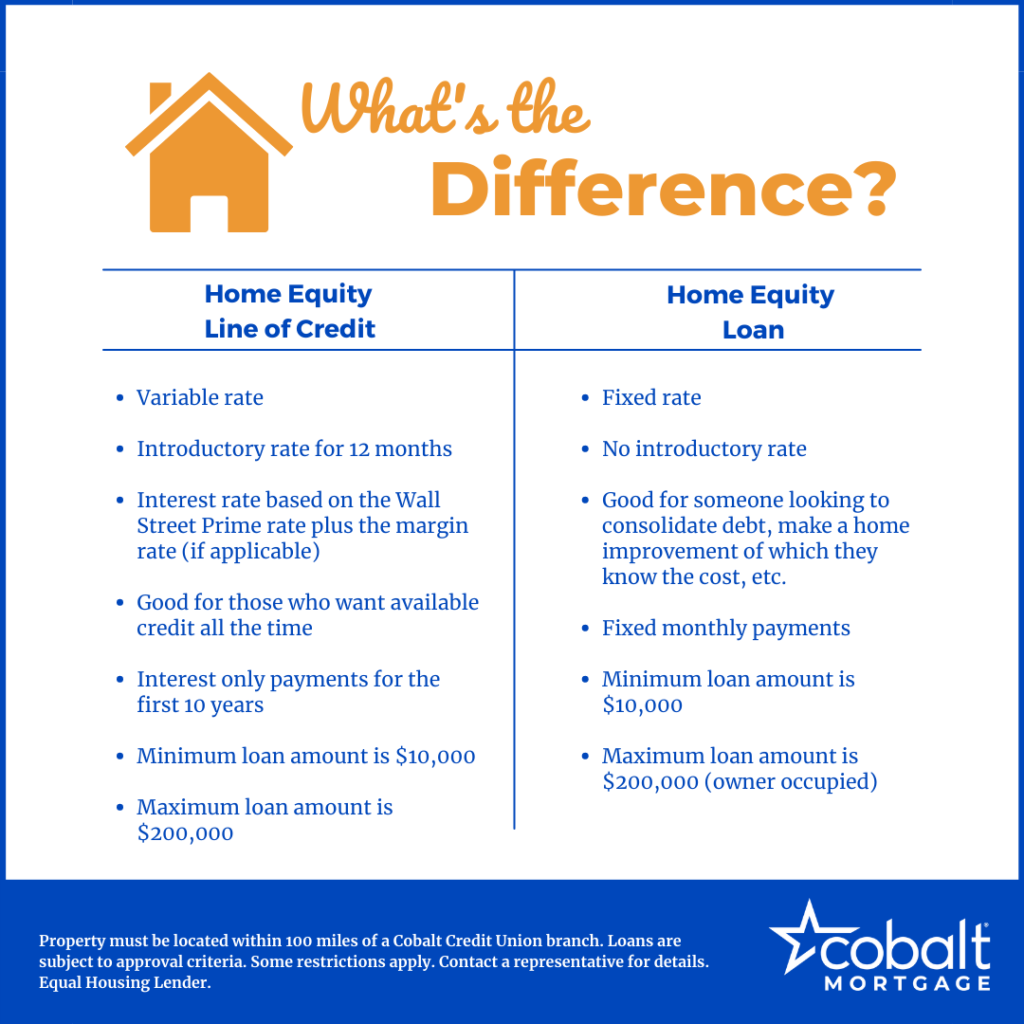

A home equity loan is a type of loan that allows homeowners to borrow money by using their home equity as collateral. Home equity is the difference between the current market value of a home and the outstanding balance of any mortgages or other liens on the property.

What is a Home Equity Loan?

With a home equity loan, you receive a lump sum of money that you can use for a variety of purposes, such as home improvements, debt consolidation, or paying for major expenses like college tuition. The loan is secured by your home, which means that if you default on the loan, the lender can foreclose on your property.

What is a Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) is a revolving line of credit that is secured by the equity in a person’s home. Equity refers to the difference between the current market value of the home and the outstanding mortgage balance.

HELOCs typically have a variable interest rate and allow borrowers to borrow up to a certain amount, based on the value of their home and their creditworthiness. Borrowers can draw on the line of credit as needed and repay the borrowed amount with interest.

HELOCs are often used for home renovations, education expenses, debt consolidation, or other large expenses. They can be a useful financial tool for homeowners who have built up equity in their homes and need access to funds for specific purposes. However, borrowers should carefully consider the costs and risks associated with a HELOC before taking one out, as failure to repay the line of credit could result in the loss of the home.

A Home Equity Loan Works to Found Your Holiday Gift Giving

If you do decide to take out a home equity loan to fund your holiday gift-giving. be sure to create a budget and stick to it. It’s easy to overspend during the holidays, but taking on too much debt can create financial stress in the new year.

A Home Equity Loan Works to Take a Holiday Vacation

Using a home equity loan to take a holiday vacation is an option, but it’s important to consider the potential benefits before making a decision.

Benefits of Home Equity Loan

Lower interest rates: Home equity loans often have lower interest rates than credit cards or personal loans, making them a more affordable option for financing a vacation.

Large loan amounts: You may be able to borrow a larger amount of money with a home equity loan than with other types of loans.

Potential tax benefits: In some cases, the interest paid on a home equity loan may be tax-deductible.

Ways a Home Equity Loan Works for the Holiday

A home equity loan can be a great way to finance your holiday expenses. Here are some ways that a home equity loan can work for the holiday season:

Access to cash: With a home equity loan, you can access the equity in your home and use it to fund your holiday expenses. This can provide you with a large sum of cash that you can use for gifts, travel, and other holiday expenses.

Lower interest rates: Home equity loans often come with lower interest rates than other types of loans, such as credit cards or personal loans. This can save you money in interest charges over the life of the loan.

Flexible repayment terms: Home equity loans typically offer flexible repayment terms. Which can make it easier for you to budget for your holiday expenses. You can choose a repayment term that works for your budget and pay off the loan over time.

Potential tax benefits: Depending on your situation, you may be able to deduct the interest. You pay on your home equity loan from your taxes. This can provide additional savings during the holiday season.

Improve your home: If you use your home equity loan to make home improvements You can increase. The value of your home and make it more enjoyable for future holidays. For example, you could use the loan to install a new deck or patio. Upgrade your kitchen or bathroom, or add a fireplace.

Loan Payments

| Loans Received Payment | yes |

| Loans Form | USE |

A Few Recommendations About Holiday Funding

Certainly, I’d be happy to provide some recommendations about holiday funding. Here are a few ideas:

- Start saving early

- Set a budget

- Consider a credit card with travel rewards

- Look for deals and discounts

- Consider alternative forms of funding

Other Uses For a Home Equity Loan

Sure, I can provide a table outlining some common uses for a home equity loan:

| Purpose | Description |

|---|---|

| Home Improvement | A popular use of a home equity loan is to fund renovations or improvements to the home. This can include anything from a kitchen or bathroom remodel to a new roof or landscaping. |

| Debt consolidation | Homeowners may use a home equity loan to consolidate high-interest debts, such as credit card balances or personal loans, into one lower-interest loan. This can help reduce monthly payments and save on interest charges over time. |

| Education Expenses | Homeowners may also use a home equity loan to pay for education expenses, such as college tuition or vocational training. This can be a smart alternative to student loans, which often have higher interest rates. |

| Medical expenses | A home equity loan can also be used to pay for unexpected medical expenses, such as surgery or hospital bills. This can help homeowners avoid high-interest medical loans or credit cards. |

| Starting a business | Some entrepreneurs may use a home equity loan to start or expand a business. This can be a risky move, as it puts the home at risk if the business fails, but it can also be a way to get funding when traditional business loans are not available. |

| Emergency funds | Finally, homeowners may choose to take out a home equity loan as a form of emergency savings. This can provide a cushion in case of job loss, unexpected expenses, or other financial emergencies. |

How to Apply for a Home Equity Loan?

Applying for a home equity loan through a lender’s website is typically a simple and straightforward process. Here are the general steps you can follow to apply for a home equity loan online through a lender’s website

- Research and choose a lender

- Visit the lender’s website

- Review the eligibility requirements

- Fill out the application form

- Submit the application

- Wait for approval

- Accept the loan

- Close the loan